Last week the Bank of Canada announced that the plan to keep the interest rate close to zero until 2023. (See article). Mortgage rates also remain low. This has sparked a discussion amongst some friends regarding mortgage rates and the idea of changing mortgages and the benefits of having a fixed or variable mortgage. I was asked for my opinion on the matter.

The fact is that I am not a mortgage agent so I cannot advise anyone regarding mortgages. I can only share my experience. Having had both a traditional mortgage as well as an all-in-one account (Manulife One) my preference is the Manulife One account. Due to the flexibility it offers one can save on the amount of interest that is paid and be debt free sooner than with the traditional mortgage.

Now, each situation is different. There is no correct answer. If you are considering refinancing your existing mortgage or taking on a new one I suggest taking a look at the Manulife One as an option. Here is some information to get you started.

-

An article entitled "How financial flexibility can help you find balance in life" - Please click here

-

An article entitled "Manulife One: Canada's Most Flexible 5-year Readvanceable Mortgage" - Please click here

-

Case study based on a real life testimonial - Please scroll down for this.

As mentioned, I am not a mortgage insurance so advise regarding specifics details of this. If you have specific questions please feel free to connect with Shagun Sharma, Retail Lending Specialist at Manulife Bank. Her contact details are as follows:

Email: Shagun_Sharma@manulife.ca

Phone: 905 841 5891

Shagun has helped some of my clients with their mortgage and borrowing needs. As discussed, I would recommend speaking with her about Manulife One and how it can help you pay less interest and become debt free sooner.

Happy reading and of course, if you have any general questions regarding this please feel free to contact me.

Regards,

Vikas Ramrakha, CIP, GBA

P: 416-558-3061

E: vikas@vrinsurance.ca

Group Benefits Associate, VR Insurance

Life, Health & Wealth Advisor, VR Insurance

November case study based on a real life testimonial

Manulife One has some real fans. Our social media is full of stories from clients who adore the product.

I've never seen clients write with such passion about cash flow solutions like dedicated Manulife One fans do.

This client moved his accounts to Manulife Bank less than a decade ago. He had a relatively small mortgage at the time but a high interest rate. He was able to consolidate his savings, his debt and home equity and paid off his mortgage within 8 years on a relatively modest income. He had excellent credit and good cashflow. Once he paid down his Manulife One account, he then bought a franchise without having to seek approval from anyone. He just wrote a cheque and then paid that off completely within 4 years. Now he earns interest on his significant positive balance and he still has access to the credit limit if he ever needs additional cash.

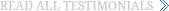

Manulife One allows you to pay down principal quickly which is how clients save significant sums. Check out the spreadsheet that shows the progress you can make with Manulife One compared to his traditional mortgage. Remember - it's not the interest rate that makes the difference - it's the total interest paid over the lifetime of the account. When I run an illustration, I show that this client saved well over $90k in interest on just his initial mortgage amount.

The additional flexibility to be his own banker and make the decision to invest in his own business? Well, that's priceless, don't you think?

)